The Netherlands’ mortgage interest rate increased sharply in 2022, but it was a little more constant last year. Mortgage interest rates varied from 4% to 5% in 2023. Homebuyers returned to the market as a result of more stable mortgage interest rates and a decline in inflation. What can we anticipate for the upcoming year, looking ahead.

Inflation in 2023 will drop back to previous levels.

Inflation and mortgage interest rates are related. You couldn’t have overlooked your electricity bill or the grocery shop receipt from the previous year. Thankfully, inflation in the EU and the Netherlands has been returning to more normal levels during the past few months. The European Central Bank (ECB) is currently expected to monitor inflation closely over the coming months in the hopes that it would stabilize at 2%.

Interest rates in the capital market

The goal of the ECB is to bring down the overall eurozone’s inflation rate to about 2%. Although it appears to be in progress right now, this is their main objective. It can be challenging at times because different EU nations experience varying degrees of inflation or other difficulties. The European Central Bank (ECB) will gradually begin lowering interest rates once more if it is certain that inflation will reach the desired levels. It is possible that this will occur in the second half of 2024.

What effects will 2024 Mortgage interest Rates have?

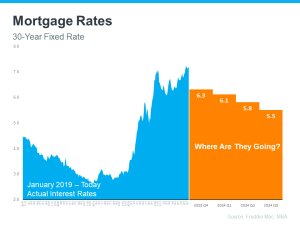

Mortgage advisors monitor the capital markets and fixed-rate government bonds every ten years. A longer interest fixed term mortgage can be well-indicated by this rate. The yield on 10-year government bonds has dropped significantly during the past three months, from 3.3% to 2.5%. Dutch mortgage lenders like ABN AMRO, ING, and Rabobank have lowered their mortgage interest rates multiple times in the last few weeks. This is particularly true for fixed terms with medium and longer interest rates, such 5, 10, or 20 years. Right now, variable interest rates are still very high. Rates should level off for the rest of the year, and by summer, they might even begin to decline.

Is it Time to Purchase a Property?

Prices are beginning to rise once more as a result of the stabilization of borrowing rates and the return of homebuyers to the market. You have to look closely at some properties that appear lovely or are in the ideal neighborhood or city. By that, we mean that there are once again overbidding amounts ranging from 25.000 to 75.000 euros above the listing rates. This isn’t the case for every property, though, as some are still available and allow for price negotiations with the seller. The Netherlands offers favorable overall conditions for property purchases, and price increases of 3% to 6% are anticipated by 2024.

Independent Dutch Mortgage Advisor for Foreigners

When buying a property, a lot of foreigners choose mortgage finance, frequently starting with their bank. On the other hand, we think that working with an independent mortgage expert is a better option. Our goal is to get foreigners the best possible offer by evaluating acceptance criteria and conditions in addition to interest rates, working with a large network of over 35 mortgage providers.

Our remarkable 99% success rate with foreign clients is a testament to our skill. We manage difficult cases including 30% decisions, foreign income, residency permits, and tax exemptions. Visit our specialized sections for properties in Amsterdam, Almere, or Eindhoven. As impartial consultants, we lead you through the whole procedure, guaranteeing success.

What are the Expenses?

In order to maintain total independence, mortgage consultants in the Netherlands are paid by their clients rather than receiving commissions from mortgage providers. In addition, they act as middlemen, taking care of application filing, document verification, and mortgage offer evaluation.Our website has information about our service prices. The first step is to explore our products at a no-obligation intake session. When we move forward, we’ll give thorough documentation.One-time expenses such as transfer tax, notary fees, and agency fees cannot be covered by the mortgage when buying real estate in the Netherlands. See our blog for typical expenses associated with purchases. Good news! In the Netherlands, one-time expenses related to mortgages are tax deductible.

How Much May I take Out on a Loan?

Your ability to borrow money is influenced by your income, current debt, mortgage structure, and interest rates. Your maximum capacity is estimated using our mortgage calculator. However, for accuracy, our mortgage experts must perform a comprehensive evaluation of interest rate variations and income components (such bonuses, 13th-month pay, or allowances). You may rely on us to provide you with precise direction during this procedure.

Profit from our top-priority alliances:

We have been chosen by ABN AMRO Bank and ING Bank as a priority partner once more for 2024. This indicates that our applications are reviewed by dedicated expat teams at each of these mortgage providers, and that the reviews are completed within a day. This leads to a quicker, less stressful, and more successful mortgage application process for our clients who are purchasing homes.

Are you a Home Owner Already?

We can help you compare different mortgage providers and programs on the market if you’re thinking about refinancing or are nearing the end of your fixed-term mortgage payment. When interest rates are low or are predicted to rise, this is especially crucial. Furthermore, in the event that you intend to relocate, we can investigate the feasibility of transferring your existing mortgage plan, which would enable you to partially maintain your advantageous rates. Our goal is to learn what suits you best.

Reduced Mortgage Interest Rates

In the interim, it might be possible to obtain a mortgage rate that is less than the usual 4.5%.In many cases, it is possible to bring your old mortgage rate with you to the new house if you are thinking of buying a new home and you have previously had a mortgage with an interest rate lower than 4.5%,” says Henk Jansen, the founder of Expat Mortgages.”Offer the mortgage.”

Furthermore, in the event that you sell your home, some banks permit the buyer to assume your previous mortgage, which can have a lower interest rate. If the seller is moving overseas and plans to repay the loan, this could be of interest to them as it gives the buyer a better rate.The CEO of Expat Mortgages, Kenneth Leenders, adds that there are some signs that housing values are not falling everywhere. The Amsterdam estate agents organization MVA has observed some indications of monthly growth in the prices of detached and corner homes, for example, despite the fact that overall house prices have decreased this year quarter over quarter.

Not a Single Mortgage Recommendation

This computation is just a simplified representation of your possible new mortgage; it is not advise (for tax or other purposes). It is advised that you speak with a tax or mortgage advisor about your specific situation.

Monthly Net Payment

The amount you will pay for the first month of your mortgage is shown here, net. With an annuity mortgage, your monthly payment will go up a little each month while the interest you pay goes down over time. This is because your net monthly payment increases as the amount of interest you may deduct from your income reduces each month. Your imputed income from home ownership is calculated using the gross monthly interest rate, the lower interest amount you can deduct from your income if you pay tax in the highest bracket, and an estimate of the value for the purposes of the Dutch Valuation of Immovable Property Act (“WOZ-waarde”).

Preserving Your Computation

Your calculation(s) can be safely saved in your own context for further use or modification. Your information won’t be seen to anybody else and will only be utilized in your private setting. Following your most recent log-in, the calculation(s) will be automatically erased after three months. Additionally, you are free to remove them whenever you choose. The computation is updated using the most recent calculating method when you log in again. This indicates that your computation is current at all times. The following may have an impact on the computation’s outcomes:

FAQS:

-

How are mortgages in the Netherlands processed?

A mortgage is a type of housing loan. You are able to borrow up to 100% of the property’s worth in the Netherlands.

-

How much savings do I need to purchase a house?

How much you may borrow based on your income and the type of home you want to buy will determine this.

-

What happens if all I have is a temporary work permit?

You may still qualify for a mortgage even in such case. It is contingent upon the kind of temporary residency visa that you possess. Additionally, the terms and conditions of the mortgage will differ from those for a permanent residence permit.