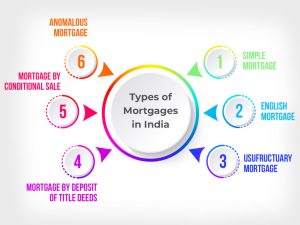

One important aspect of real estate transactions is mortgages, which are covered in detail by the Transfer of Property Act. With a mortgage, people can use their real estate as security to get loans.But not all mortgages are created equal; there might be differences in terms of rights, responsibilities, and legal ramifications. The Transfer of Property Act defines a number of distinct kinds of mortgages.

Mortgage Under the Transfer of Property Act

A mortgage is a legal arrangement in which an interest in a particular piece of real estate is transferred in order to guarantee the repayment of a loan, whether it is one that is already outstanding or one that may come up in the future. The person who transfers the property is known as the mortgagor, and the person who receives it and is the loan lender is known as the mortgagee.

The term “mortgage money” refers to the total amount borrowed, interest included. A mortgage deed is usually used to formalize the transfer of property. In conclusion, a mortgage is a way for people to get a loan with clear conditions and responsibilities for all parties involved, utilizing their property as security.

Mortgage Types As per the Transfer of Property Act

Easy Loan

A simple mortgage is the kind of mortgage that is described in Section 58(b). A simple mortgage does not transfer ownership of the property to the mortgagee; instead, the mortgagor pledges to personally repay the amount.

Additionally, the mortgagor consents to the mortgagee’s right to sell the property and utilize the revenues to pay off the loan in the event that they are unable to repay it.

Simple mortgage components that are essential are:

1.The loan will be individually repaid by the mortgagor.

2. The mortgagee does not receive the property.

3. As security for the loan, the mortgagor assigns the right to sell the property in the event that they are unable to repay it.

The personal responsibility of the mortgagor to repay the debt is a crucial component of a basic mortgage. When the loan is approved, there may be an express obligation or one that is inferred from the conditions of the agreement. However, the conditions of the mortgage transaction may alter this responsibility in specific situations, such as a usufructuary mortgage.

Mortgagor Receives the Remaining Proceeds.

With a straightforward mortgage, the property is still owned by the mortgagor. The property itself provides the mortgagee with security; whatever income or profits it makes are not taken into account. Section 68 states that a simple mortgagee who wants to enforce their security cannot get a possession decree. As an alternative, it would change the status of the simple mortgagee to one with possession.In the event that the mortgagor defaults on the debt, the mortgagee is entitled to sell the property. However, the court must step in to stop this power of sale. This implies that in order to carry out the transaction, the mortgagee needs to get a court order. The mortgagee gets the advance amount plus interest when the property is sold through the court system, and the mortgagor receives the remaining proceeds.

Utilized as Collateral Security for Stridhan

A particular piece of property was utilized as collateral security for stridhan in the case of Mathai Mathai v. Joseph Mary, and the mortgagor was in charge of paying interest on the loan repayment. Nevertheless, there was no clause addressing the transfer of possession in the mortgage deed. Consequently, the court decided that this specific instrument need to be categorized as a straightforward mortgage.The court upheld the interpretation of Section 58(b) of the Transfer of Property Act 1882 in the case of Kishan Lai v. Ganga Ram. The court explained that the mortgagee cannot arbitrarily exercise the power of sale, as implied by the words “right to cause the property to be sold.” Rather, the selling procedure cannot proceed without the court’s intervention.

Conditional Sale Mortgage

The definition of a mortgage by conditional sale is given in Section 58(c). This kind of mortgage involves a condition tied to the mortgagor’s apparent sale of the property to the mortgagee. The sale becomes final if the mortgage funds are not paid off by a specific date; alternatively, the buyer may return the property to the seller or the deal may become void if the payment is made. The same document that impacts the sale must include this requirement.The mortgage by conditional sale was created by Muslims to get over their religious ban on collecting interest on loans. They were able to keep their consciences free and still get the principal and interest from this kind of mortgage.

Mortgage with Usufruct

The definition of a usufructuary mortgage is provided in Section 58(d) of the law. In a usufructuary mortgage, the mortgagor either agrees to give the mortgagee possession of the property or does so themselves.The mortgagee is permitted to keep the property in possession until the mortgage balance is settled, and they are also permitted to keep the rent and property earnings. These rentals and profits may be totally or partially utilized by the mortgagee in lieu of interest or mortgage payment.

Transfer of Ownership

As security for the mortgage funds, the mortgagor gives the mortgagee possession of the property. Until the loan is settled, the mortgagee is still the owner of the property. The actual handover of possession may be agreed upon by the mortgagor through an express or implied obligation, rather than at the time of execution of the mortgage deed.

Profits and Rent

Until the mortgage debt is settled, the mortgagee is entitled to the rentals and profits made by the mortgaged property. The conditions of the mortgage deed determine how the profits and rents are allocated. Rents and profits may be used by the mortgagee in place of principle, interest, or both. When the mortgagor can reclaim the property depends on the exact conditions.

No Mortgagor Personal Liability

The mortgagor in a usufructuary mortgage is not personally liable for loan repayment. To pay off the mortgage balance, the mortgagee must use the property’s rents and earnings. Since it is difficult to foresee when the debt will be entirely repaid, the mortgage’s length is unlimited.

The Mortgagee’s Rights

The mortgagee may file a lawsuit to regain possession of the property or to recoup the advance payment if the mortgagor does not deliver it. The only option available to the mortgagee, though, is to keep the property until the obligations are paid off if they have already been granted possession. There is no right of foreclosure or sale for the usufructuary mortgagee. One benefit for the mortgagee is that they can use their profits and rents to pay off their mortgage.

Usufructuary Mortgagor’s Rights

In some situations, a usufructuary mortgagor may be able to reclaim ownership of the property from the mortgagee under Section 62. These situations include when the mortgagee was allowed to deduct the mortgage payment from their profits and rentals, and the mortgage amount is paid, or when the mortgage payment terms have passed. The money is either deposited in court or paid to the mortgagee by the mortgagor.

In Prabhakaran v. M Azhagiri Pillai, the mortgagor gave the mortgagee an interest in his property, allowing the mortgagee to keep possession and benefit from rent and profits until the debt was paid in full. According to the court, the mortgagor in a usufructuary mortgage is not personally liable for anything after this arrangement.

The mortgagee’s rights

Even if entry is not expressly granted, the mortgagee in an English mortgage has the right of possession. The mortgagee may keep ownership of the property until the entire debt is paid off. The proceeds from the property, if the mortgagee is in possession of it, will be applied against the mortgagee’s outstanding debt.For instance, if A, the buyer, purchases the property from B, the mortgagor, through a sale deed and B doesn’t pay, A just needs to register the sale deed because they now own all of the property rights.

The Title-Deed Deposit

Constructive delivery of the documents is sufficient; physical delivery is not required. The deposit of all title documents is not necessary for a legal equitable mortgage; nonetheless, the deeds that are deposited must be authentic, pertinent to the property, and provide material proof of title. Let’s say that additional documents prove the person’s ownership of the property but are not deposited, and a title deed is absent among the deposited paperwork. Then, there is no creation of an equitable mortgage.

Goal to Establish Security

The idea behind the transaction is that the borrowed money (debt) will be secured by the title deeds. A mortgage is not created by merely transferring the title deeds from one individual to another. It must be fulfilled when the deeds are delivered that they will act as security for the debt.