Denmark’s Greatest Mortgage Calculator

As everyone knows, Denmark is one of the most beautiful cities in all of Europe. Bright and vibrant, the country boasts stunning landscapes, coasts, a bustling cultural scene, strong industries, and adequate healthcare systems. Whoa! Furthermore, the nation consistently ranks highest in the world when it comes to happiness.Therefore, for everyone hoping to settle down in this rural nation, now is the perfect time to purchase a home with competitive mortgage rates. Nevertheless, the blog that follows will assist you in sifting through the many online mortgage loans for prospective buyers so that you don’t end up on a roller coaster trip in the Danish market.

Mybanker.dk is Among the Top Mortgage Lenders in Denmark.

An entirely digital mortgage comparison tool called Mybanker.dk can assist you in taking charge of your personal finances. They do a free mortgage comparison for you between various institutions. See the lending choices offered by their partner banks and receive further offers. utilizing an application Moving a mortgage to Mybanker.dk can save an average household more than DKK 10,000 annually. Transferring your mortgage is simple because Mybanker.dk handles all the paperwork. According to Trustpilot, they also have an excellent customer satisfaction ratio. Please visit the website to see if you are interested in applying for a new mortgage.

Why is a Mortgage Calculator Necessary, and What Does it do?

First things first, you must understand the Danish mortgage system before you get very excited about purchasing a home there. To begin with, before making a real estate investment, one of the requirements is to use the mortgage calculator, Denmark. The mortgage loan schedule in Denmark is very different from other nations, which is one of the main distinctions when investing here. You would typically observe that Danish real estate is highly erratic and fast-paced.

However, you shouldn’t let that depress you because this market is also well-stocked with other goods. A few essential elements that you won’t discover somewhere else include early payments, interest rates, and financial stability. Therefore, if you’re a wise investor, don’t ever be afraid to use the finest mortgage calculator available online.

In What Ways Might a Mortgage Calculator be Useful?

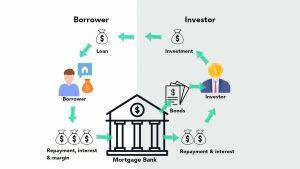

A mortgage calculator assists you in determining whether or not you can afford the investment, regardless of your level of experience. The calculator also assists you in tracking your budget and determining the amount that will be due each month.In Denmark, obtaining a mortgage can be very difficult. Financial institutions across the nation provide mortgages through the issuance or sale of covered bonds, adhering to the match-funding principle. Apart from this, the nation’s homebuyers have a number of advantages.

How Does one go About Purchasing Real Estate in Denmark?

It will be difficult for you to advance in the industry if you have never purchased real estate before. But in Denmark, prospective buyers have it simple thanks to the mortgage loan schedule and other elements. All you need to know is that there are particular procedures that people must follow:

Apply Now and Have your Mortgage Approved Quickly:

When you decide to purchase a home, one of the first things you should do is apply for a mortgage. Go to a bank and find out how much you may borrow instead of waiting till you have discovered your ideal house.This will simplify the house-buying process for you and provide you with clarity throughout the search. The important thing to remember in this situation is that the entire financing process will vary based on your citizenship. The down payment for a non-EU citizen is 10–40%, however it varies by 5% if you are a member of the European Union.

Locate The Ideal House:

Once the loan application procedure has gone well, it’s time to start looking for your ideal property. Always remember to keep the following things in mind: daycare options, grocery stores, schools, and infrastructure.After deciding on the perfect property, you may talk about the other details, including savings, and complete the transaction.

Examine Purchase Documents:

The next stage, either on your own or with a lawyer’s assistance, is to scan all of the purchase documents once everything has been decided. After all the paperwork has been reviewed and authorized, it can be submitted to the registration court, whereupon you will take title to the property.

How do You go about Purchasing an Apartment?

The next step is to conduct a thorough inspection of the property when you have decided to purchase one in Denmark and all financing and other matters have been resolved. It is frequently seen that the seller presents a very positive description of the home. But resist the temptation.You can ask your friends to check out the property for you, or you can do it yourself. This way, before you move in permanently, you may inspect the damage, inadequacies, and perform a thorough audit of your house.

What other Considerations Should I Make?

There are additional costs to consider in addition to the several monthly installments. These consist of the commitment charge, the total cost of applying for a mortgage, and additional costs associated with refinancing.

It’s also important to keep in mind that Danish mortgage loans are backed by callable bonds. This implies that you can pay off the loans at their face value and find another way to get money. Even if they all appear like minor details, they should all be kept in mind. So, in order to get a better price, do follow these guidelines before you go out to buy a house.

Purchasing a Home in Denmark Following Brexit

It could be difficult for an EU national to purchase real estate in Denmark. But since the UK exited the EU, things have gotten quite tough for British expats.Since British nationals are now considered non-EU citizens, purchasing a property in Denmark requires a valid business or residence permit, a valid visa, and proof of residency for at least five years.

What is the Price of Purchasing Real Estate in Denmark?

You won’t be shocked to learn that, particularly when compared to the UK, living expenses in Denmark and other Scandinavian nations may be somewhat high.The same is true of property costs, which might change based on the kind of house and your preferred area of residence. Purchasing a property in the thriving city center of Copenhagen will cost more than purchasing one on the outskirts of Vejle, a tiny but lovely port city.Let’s look at apartment prices in and around various cities in GBP to assist you compare with UK prices and get a sense of how much it could cost you to buy a property in Denmark.

An Illustration of a Mortgage Loan

To help with the comprehension, let’s look at an example of a Danish mortgage loan. The following example will list the essential loan parameters for a fictitious situation.In this instance, the borrower purchases a property with a 1,500,000 DKK mortgage. Because the loan has a fixed interest rate of 3%, the interest rate won’t change over the course of the loan. The loan has a 20-year term, which translates into 8,381 DKK in monthly payments. The borrower will pay 513,840 DKK in interest over the course of 20 years, making the total amount repaid 2,013,840 DKK.The actual mortgage terms may differ depending on the lender, the borrower’s creditworthiness, and the state of the market; this is only a basic sample. To obtain a more precise estimate that is suited to their unique situation, prospective borrowers should use mortgage calculators or speak with financial experts.

In Summary

Relocating abroad is a significant decision. It is almost necessary for you to leave your home country and relocate overseas. However, obtaining a mortgage in Denmark will become reasonably simple with the aid of our advice.You don’t need to worry about the extras; simply go ahead and settle the matter in the finance section, which will take you directly to your house. Aside from that, a mortgage calculator can assist you in determining the affordability of the loan and ensure a smooth and trouble-free transition to the country.

FAQS:

-

Is mortgage lending available in Denmark?

In Denmark, it is possible for non-residents to apply for a mortgage, albeit there can be further criteria for them.

-

Is purchasing a home in Denmark challenging?

The market and regulatory aspects of the process can make it complicated, but it is manageable with the right planning and direction.

-

In Denmark, how much can you borrow for a mortgage?

The maximum amount you can borrow is usually up to 80% of the property’s value, though it usually depends on your financial status and the property’s worth.